Paying off your House... the Best Way to LOSE Money!

Return on Equity — perhaps the most important real estate metric you should be considering.

Sometimes I drive my wife nuts.

I take too long to explain things...

I open the fridge and freezer doors at the same time...

Or I use this phrase: “it’s just a math problem.”

Whenever my wife and I talk about money or investing, I always just shrug and say, “it’s just a math problem”… because it always is: inputs, outputs, variables, solver functions, risk profiles, etc.

It’s just math, and math is why I will never pay off a house.

Don’t pay off your house? You’re crazy!

Maybe, but let’s do some math. Particularly, let’s talk about Return on Equity.

In real estate, and particularly real estate investing, there are tons of metrics that people look at: Cap Rate , Cash on Cash Return , IRR, etc. We’re going to focus on Return on Equity, which, as you might have guessed from my last post , is my go-to.

Defining Return on Equity is quite easy (much easier than the others). It’s… drumroll… the return on all your equity ( wow ). I’ll illustrate it with a bank account example.

You put $1,000 in a bank account. That is your equity investment, or maybe we could even call it a down payment (hmmm…).

The account pays 1% annually. So, at the end of year one you now have $1,010 (yes, I know there are other factors here too, we are keeping it simple). You had to tie up $1,000 worth of equity to make $10 and thus had a 1% return on equity. This repeats year after year with the total equity commitment increasing each year ($1,000… $1,010… $1020.10… etc).

Do not confuse this with Cash on Cash return, which only compares against the initial equity investment, not the current available equity (more on this in our next post).

The nice thing about a bank account is the Return on Equity rate is basically fixed regardless of how much equity you have. However, in real estate, it’s not fixed at all, and this is where people get in trouble.

Let’s look at Return on Equity in real estate now.

First, there are a few variations of the formula. Here is the one I like:

Return on Equity (ROE)= Total Annual Increase / Total Equity

We will start with the easiest of the two: total equity. Total equity is the current value of the home minus any debt owed (your outstanding loan or mortgage balance(s)). If you want to see your ROE for the past year, we recommend using your total equity from the start of the period instead of the end of the period (because your equity is always changing!). However, either works, just be consistent.

So, if the home is worth $400,000 and you owe the bank $300,000, you have $100,000 in equity.

What is “total annual increase?” It is the increase in value that you captured that year from the property. Some of that value will be in your hand, like the cash flow you are ideally getting each month. The remainder of that value will be from the increase in your equity balance. This comes from property appreciation as well as principal pay-down (this is why your equity is always changing!), which increase (or decrease) your total equity.

So, we could rewrite the formula:

Return on Equity (ROE) = (Annual Cash Flow + Annual Equity Increase ) / Total Equity

Or, to get super technical by defining each of the variables in the equation:

Return on Equity = ( (Total Annual Income — Total Annual Expenses) + ((Current Home Value — Current Loan Balance) — (Previous Year Home Value — Previous Year Loan Balance))) / (Previous Year Home Value — Previous Year Loan Balance).

Let’s look at Return on Equity in action.

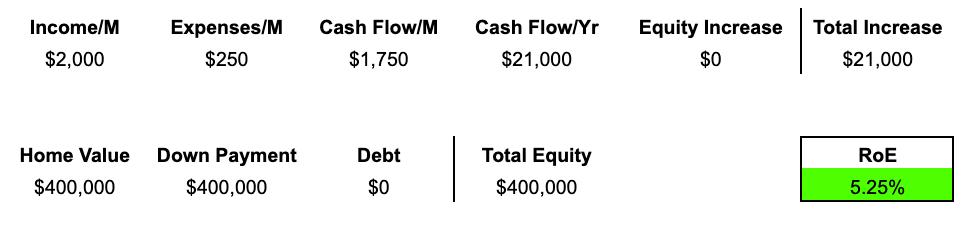

Let’s say you bought that $400,000 house we just mentioned above, but in cash. No loan. So you have the full $400,000 in equity.

You rent out the house each month for $2,000. You don’t have a mortgage payment, but you still have to pay property taxes, insurance, etc, which, let’s say, is $250/m, so your cash flow is $1,750 monthly or $21,000 annually. For simplicity, let’s assume there is no appreciation during the year.

You then divide your $21,000 increase by your $400,000 in equity to get your ROE of 5.25%.

In other words, you had to tie up $400,000 to make $21,000 — a 5.25% return. Not bad. It is definitely better than 1% from the bank account.